massachusetts meal tax calculator

15 Tax Calculators 15 Tax Calculators. The Massachusetts Income Tax Calculator Will Let You Calculate Your State Taxes For the Tax Year.

Massachusetts Sales Tax Small Business Guide Truic

106250 What is the sales tax rate in Massachusetts.

. The Massachusetts sales tax is 625 of the sales price or rental charge of tangible personal property including gas electricity and steam and telecommunications services 1 sold. 54 rows The Sales Tax Calculator can compute any one of the following given inputs for the remaining two. Massachusetts Income Tax Calculator 2021 If you make 70000 a year living in the region of Massachusetts USA you will be taxed 11667.

The Federal or IRS Taxes Are Listed. The meals tax rate is 625. Anyone who sells meals that are subject to sales tax in Massachusetts is a meals tax vendor If a liquor license holder operates a restaurant where.

To use our Massachusetts Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. The maximum tax that can be enacted on meals in Massachusetts compares favorably to that in other New England states. Local tax rates in.

Massachusetts is a flat tax state that charges a tax rate of 500. Clothing purchases including shoes jackets and even costumes are exempt up to 175. The base state sales tax rate in.

A local option meals tax of 075 may be applied. The base state sales tax rate in Massachusetts is 625. Most food sold in grocery stores is exempt from sales tax entirely.

The advance payment required is the liability that must be reported on the line items identified above. The Massachusetts sales tax is 625 of the sales price or rental charge of tangible personal property including gas electricity and steam and telecommunications. Purchase Amount Purchase Location ZIP Code -or-.

That goes for both earned income wages salary commissions and unearned income interest and dividends. How much is sales tax in Massachusetts. A 625 state meals tax is applied to restaurant and take-out meals.

It may be based on either 1 the portion of the tax liability from the 1st. A call center is also now available at 877. Hotel rooms state tax rate is 57 845 in Boston Cambridge.

Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to Massachusetts local counties cities and special taxation. 625 state sales tax 1075 state excise tax up to 3 local option for cities and towns Monthly on or before the 20th day following the close of the tax period. The Baker administration has set up a website wwwmassgov62frefunds where you can get a preliminary estimate of your refund.

Massachusetts Income Tax Calculator 2021 If you make 70000 a year living in the region of Massachusetts USA you will be taxed 11667. Before-tax price sale tax rate and final or after-tax price. Most food sold in grocery stores is.

The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. After a few seconds you will be provided with a full. Connecticuts meals tax is 635 percent followed by Massachusetts.

Your average tax rate is 1198 and your. Massachusetts Income Tax Calculator 2021 If you make 70000 a year living in the region of Massachusetts USA you will be taxed 11667.

Sales Taxes In The United States Wikipedia

Car Tax By State Usa Manual Car Sales Tax Calculator

4 Ways To Calculate Sales Tax Wikihow

How To Pay Sales Tax For Small Business 6 Step Guide Chart

New Mexico Sales Tax Calculator

Sales Tax Calculator And Rate Lookup Tool Avalara

How To Calculate Cannabis Taxes At Your Dispensary

Massachusetts Vehicle Sales Tax Fees Calculator Find The Best Car Price

Item Price 70 Tax Rate 18 Sales Tax Calculator

Sales Tax Calculator Check Your State Sales Tax Rate

Massachusetts Sales Use Tax Guide Avalara

Sales Tax Calculation Zip Codes Are A Start But Not Enough Article

1099 Tax Calculator How Much Will I Owe

State Sales Tax Rates Sales Tax Institute

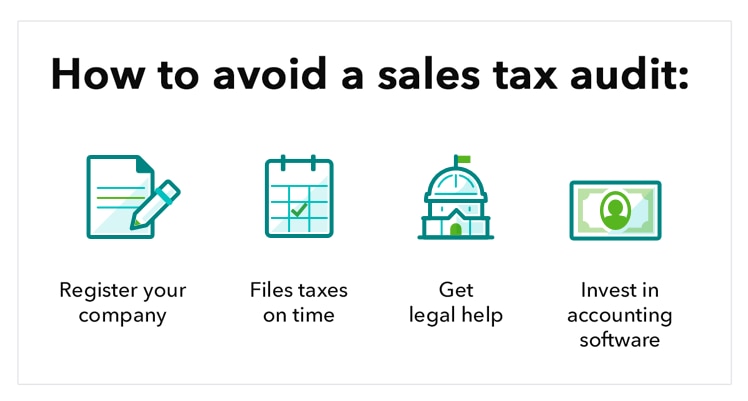

How To Calculate Sales Tax And Avoid Audits Article

Massachusetts Vehicle Sales Tax Fees Calculator Find The Best Car Price